Positive trends. Positive in that they are growing and positive in that I try to keep to trends impacting the world for human benefit.

Monday, December 23, 2013

Images for A Solemn Song

Saturday, December 14, 2013

Writing Revolution- Best thing since movable type?

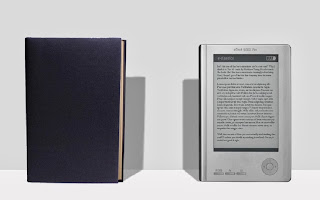

Since then, printing technology has continued to improve but not until recently has there been another complete overhaul. First, personal computers re-thought desks and may have helped us at work but they still didn't quite replace the book. (I think its interesting that Steve Jobs who was influential in the death of written material appreciated very much fonts, typeface and feel of letters, its almost as if he, the father of the revolution, wanted to preserve a vestige of a culture he was about to lay waste to, but was I'll post about him later.) Then came the kindle. Now we have these book-like tablets that can hold loads of books and don't waste paper or have to buy a new editions each time there are changes or edits. The pros and cons are many and the debate continues where ever people consider buying a tablet.

Since then, printing technology has continued to improve but not until recently has there been another complete overhaul. First, personal computers re-thought desks and may have helped us at work but they still didn't quite replace the book. (I think its interesting that Steve Jobs who was influential in the death of written material appreciated very much fonts, typeface and feel of letters, its almost as if he, the father of the revolution, wanted to preserve a vestige of a culture he was about to lay waste to, but was I'll post about him later.) Then came the kindle. Now we have these book-like tablets that can hold loads of books and don't waste paper or have to buy a new editions each time there are changes or edits. The pros and cons are many and the debate continues where ever people consider buying a tablet.In the end, you can debate it all you want, but price tends to be one of the best guides of how practical things are. If I can get the same book more cheaply and quickly on a tablet, eventually the shift will happen, though as yet print has proven resilient. Another salient advantages of a tablet is as a space saver, so where space is at a premium like in a small apartment, in the city or trudging through the desert sand, sweatily lugging around a bunch of books, a tablet should win. The fall out of of the subsequent shift to digital has already been substantial: small or weakly managed newspaper, magazine and book companies have been gone out of business and many jobs lost(1), although some larger well capitalized companies with forward thinking management have successfully transitioned to online and e-books. But the floodgates are now open and I don't think the digital wave will relent.

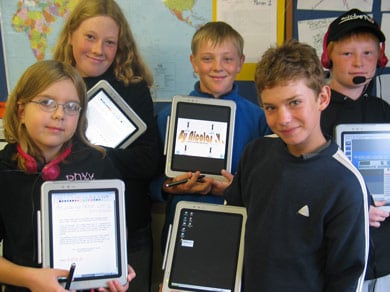

We can guess that the next in line are slower moving institutions like schools and I still wonder what will become of libraries if books become obsolete? One version of a book-less library attempt is already underway in San Antonio Texas. (4)

In schools, billions of dollars and more importantly, children's minds are at stake on when an how tablets will relate to textbooks. With the promise of didactic games and easy monitoring of students activity, convincing academia is all too easy. Teachers agree, it makes and sense so why hasn't it happened yet? Well, while there may be a huge potential future in filling schools with tablets, who exactly will stake a claim in this wide open territory is currently in serious contest. Doing it right is what really matters and real improvements don't usually happen the way we expect them to. Trying to get something as complex as a computer that is as intuitive and durable, in short, re-inventing the textbook, is not exactly child's play. In LA they've tried just throwing full size i-pads at kids with mixed results.(2) Remember, we're dealing with kids, probably one the most un-predictable force in the universe. In Bridge, the for-profit, mass-education enterprise in Africa, they use tablets in class in a different way, to give the curriculum solely to the teacher. Personally, I'm kind betting on Amplify as a major player in the US. They are probably most aggressively pursuing and trying to profit from tablets in schools though with no major success yet.(3) So yes, tablets may largely replace books in schools, but we can expect some failures and wasted government and corporate resources before someone gets it right. I'm sure though, with the right incentive and vision some very smart, motivated and focused people could get it done, but when those elements will combine nobody knows for certain. My own relationship with a tablet has come a long way, I started out neglectful but have since found myself using it on occasion, still its not anywhere close to books yet.

*http://en.wikipedia.org/wiki/File:Literacy_rate_world.svg

**Other episodes http://vimeo.com/11891919 , http://vimeo.com/11891958 , http://vimeo.com/11891958# ,

http://vimeo.com/11892454, http://vimeo.com/11892516 also interesting http://darwinslibrary.com/

1) http://newsosaur.blogspot.com/2012/04/four-ways-newspapers-are-failing-at.html

2) http://www.latimes.com/business/hiltzik/la-fi-mh-ipad-adventure-20131120,0,942881.story#axzz2n3JmPH8H http://www.macworld.com/article/2065460/ipads-in-schools-the-right-way-to-do-it.html http://www.npr.org/blogs/alltechconsidered/2013/10/25/240731070/a-schools-ipad-initiative-brings-optimism-and-skepticism

3) http://mashable.com/2013/08/29/news-corp-education-tablets/

http://www.geekwire.com/2013/tech-tablets-schools-mix/

http://slashdot.org/story/13/10/08/1952215/nc-school-district-recalls-its-amplify-tablets-after-10-break-in-under-a-month

4)http://www.latimes.com/books/jacketcopy/la-et-jc-nations-first-bookless-public-library-system-opens-20140107,0,7098801.story#axzz2pmce0gj5

Tuesday, December 10, 2013

Refracting Sunset

Refracting Sunset

Acrylic

This one is more of concept art I guess. I was thinking of an image that explores the nature of light, not so much what it illuminates, but the light itself. A continuous wave that bounces around until it gets absorbed or some of the wavelengths are absorbed producing color and shade by shade eventually darkening. This is what turned out. Kind of looks like a cubist sunset, a stain-glass or as Ross says "diamond sunset." It'll probably end up on the wall at Sun Terrace. I might at some point to do another variation maybe using neon colors or making it more symmetrical or using a computer.

Wednesday, December 4, 2013

The Thoughtful Investor- The Intelligent Investor for the Modern Mind

Benjamin Graham's modern equivalent is this guy: Seth Klarman. Some may think that Warren Buffet is living out Graham's principles, but more than anyone Klarman really mirrors Graham's thinking.* Like Graham, Klarman grew up Jewish and on the East Coast. They both did well in school and had plenty of opportunities in academia but decided to take to money management instead. Like Graham, Klarman's greatest claim to fame was a book he published: Margin of Safety- Risk Averse Strategies for the Thoughtful Investor bleck! what an unappealing mouthful of a name! I'll just call it the Thoughtful Investor.

The weird thing about the Thoughtful Investor is that the book itself is kind of an object lesson in investing. If you look on Amazon right now its selling for about $2000 used! As happens with many stocks this thing is way over-valued and if you are a real value investor you wouldn't think of paying that much for a silly book. I think this also is telling of the kind of ridiculous thinking that goes on among the types of people have their head in finance. People in these circles produce the outrageous thinking that paying that kind of money for something so simple could actually be worth it! If you want to read the book and are a normal human being that doesn't throw around $2000, just look for it online, there are PDF's of the text floating around out there or e-mail me and I'll send you a copy.

The weird thing about the Thoughtful Investor is that the book itself is kind of an object lesson in investing. If you look on Amazon right now its selling for about $2000 used! As happens with many stocks this thing is way over-valued and if you are a real value investor you wouldn't think of paying that much for a silly book. I think this also is telling of the kind of ridiculous thinking that goes on among the types of people have their head in finance. People in these circles produce the outrageous thinking that paying that kind of money for something so simple could actually be worth it! If you want to read the book and are a normal human being that doesn't throw around $2000, just look for it online, there are PDF's of the text floating around out there or e-mail me and I'll send you a copy.

So what does Klarman talk about that is so valuable? Really, its mostly a modern, version of The Intelligent Investor. The language is more polished, and the approaches are more up to date, but the principles are much the same. Where Graham used Price/ Earning, Book Value and Dividends, Klarman uses Net Present Value, Liquidation Value and Stock market Value to gauge price. He defines Net Present Value as the discounted value of all future free cash flows a business is expected to generate. Klarman also mentions private market value as a rule of thumb which I completely agree with, to give an idea of a businesses value when the market's going nuts. One useful resource I've found for private company info http://www.privco.com/ Klarman also brought to my attention spin-offs as a re-occurring source of investing opportunities.

Even though Klarman isn't as original as Graham, he makes some great points and brings a modern intellect to Grahams principles. He has greatly added to the value investing cannon by writing and practicing value investing and is definitely a heavy hitter in the world of finance.

*One difference I see between Buffet and Klarman is their holding time. Klarman thinks its necessary to "continually compare their current holdings in order to ensure they own only the most undervalued opportunities available." Buffet says "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." I think Buffet is a less likely to sell just because he sees something better out there, while Klarman might try a little too hard to demand the best bargain as did Graham.

Klarman also says: "Few value investors own technology companies, banks or insurance companies because they have un-analyzable assets and liabilities." If he sticks to this, it would be a huge difference between him and Buffet, Buffet obviously has no problem investing in banks like Wells Fargo and his first and most successful investments were GEICO and Illinois National Bank and Trust.

And finally, Klarman also demands hard assets to provide safety while Buffet is more comfortable with a strong moat whether its tangible or not.

Other quotes that I found interesting, useful or just plain liked in his book:

"Value, like beauty is often in the eye of the beholder."

So what does Klarman talk about that is so valuable? Really, its mostly a modern, version of The Intelligent Investor. The language is more polished, and the approaches are more up to date, but the principles are much the same. Where Graham used Price/ Earning, Book Value and Dividends, Klarman uses Net Present Value, Liquidation Value and Stock market Value to gauge price. He defines Net Present Value as the discounted value of all future free cash flows a business is expected to generate. Klarman also mentions private market value as a rule of thumb which I completely agree with, to give an idea of a businesses value when the market's going nuts. One useful resource I've found for private company info http://www.privco.com/ Klarman also brought to my attention spin-offs as a re-occurring source of investing opportunities.

Even though Klarman isn't as original as Graham, he makes some great points and brings a modern intellect to Grahams principles. He has greatly added to the value investing cannon by writing and practicing value investing and is definitely a heavy hitter in the world of finance.

Klarman's Fund https://www.baupost.com/

*One difference I see between Buffet and Klarman is their holding time. Klarman thinks its necessary to "continually compare their current holdings in order to ensure they own only the most undervalued opportunities available." Buffet says "When we own portions of outstanding businesses with outstanding managements, our favorite holding period is forever." I think Buffet is a less likely to sell just because he sees something better out there, while Klarman might try a little too hard to demand the best bargain as did Graham.

Klarman also says: "Few value investors own technology companies, banks or insurance companies because they have un-analyzable assets and liabilities." If he sticks to this, it would be a huge difference between him and Buffet, Buffet obviously has no problem investing in banks like Wells Fargo and his first and most successful investments were GEICO and Illinois National Bank and Trust.

And finally, Klarman also demands hard assets to provide safety while Buffet is more comfortable with a strong moat whether its tangible or not.

Other quotes that I found interesting, useful or just plain liked in his book:

"Value, like beauty is often in the eye of the beholder."

Once

you adopt a value-investment strategy, any other investment behavior starts to

seem like gambling.

Some people act responsibly and deliberately

most of the time but go berserk when investing money. It may take months or

years of work and discipline to earn the money and only a few minutes to invest

it. Some spend more time buying a stereo or camera than buying stocks. Many

regard the stock market as a way to make money without working rather than a way

to invest capital in order to earn a decent return.

Greedy

short-term-oriented investors may lose sight of a sound mathematical reason for

avoiding loss. It is very difficult to

recover from even on large, loss, which could literally destroy all at once the

beneficial effects of many years of investment success.

Downfalls

For Institutional Investors: Size, Self

Imposed Constraints and Willful Ignorance of Fundamental Analysis.

I believe indexing will turn out to be just another Wall Street fad. (REALLY??!!)

Above all, investors must avoid swinging at bad pitches.

I believe indexing will turn out to be just another Wall Street fad. (REALLY??!!)

Above all, investors must avoid swinging at bad pitches.

If the prevailing stock price is not

warranted by the underlying value, it will eventually fall.

Value investors are not super sophisticated

analytical wizards who create and apply intricate computer models to find

attractive opportunities or assess underlying value. The hard part is

discipline to avoid the many unattractive pitches, patience to wait for the

right pitch and judgment to know when to swing.

There are only a few things investors can do

about risk: diversify adequately, hedge when appropriate and invest with a

margin of safety.

Many

investors insist on affixing exact values to their investments, seeking precision in an imprecise world,

but business value cannot be precisely determined.

How do value investors deal with the analytical

necessity to predict the unpredictable? The only answer is conservatism.

Investors relying on conservative

historical standards of valuation in determining private-market value will

benefit from a true margin of safety, while others’ margin of safety blows with

the financial winds.

Like Einstein’s theory of relativity this (Soros's theory of reflexivity) may

slightly affect calculations but only in rare or extreme circumstances, and for

the most part fundamental analysis is still on largely right.

Spinoffs seem to frequently be undervalued and large emerging industries seem to be frequently overvalued like

railroad companies were, air freight was, computer companies were.

...it is important to remember that numbers are not

an end in themselves. Rather they are a means to understand what is really

happening in a company.

Good investment ideas are rare and valuable

things, which must be ferreted out assiduously.

Value

investing by its very nature is contrarian. Value investing exists where the

herd is selling, unaware or ignoring.

Information

generally follows the 80/20 rule: the first 80 percent of the available

information is gathered in the first 20 percent of the time spent.

No one understands a business and its prospects

better than the management.

Arbitrage is a riskless transaction that

generates profits from temporary pricing inefficiencies between markets.

Although trading based on inside information is

illegal, the term has never been clearly defined.

And my very favorite! "Value, like beauty is often in the eye of the beholder."

Tuesday, November 26, 2013

Virtual Reality Check

If I had to take a guess what will be one of the most popular new consumer devices in 2014 ( the next i-phone) my pick would be the Oculus Rift. The Oculus Rift is a virtual reality head-set originally designed for video games. Yes, there have been a lot of attempts at Virtual Reality in the past and no one knows this better than the guy who designed this one, Palmer Luckey. Over a few years he collected about 56 different Virtual Reality Head sets including one that cost $97,000 which he nabbed for $80. He began taking them apart and tinkering with them in his parents garage. Out of that creative process emerged the prototype for what is now known as the Oculus Rift. But just getting the prototype built is one thing but having financial backing to see it built and do it at an affordable cost is very different. That's where Kickstarter.com has helped. Through the use of this "crowd-sourcing" website he raised $2.5 million and gained some momentum in actually bringing the device to the people who could design games for it. He has since recruited a big name in the gaming industry John Carmack among others.

If I had to take a guess what will be one of the most popular new consumer devices in 2014 ( the next i-phone) my pick would be the Oculus Rift. The Oculus Rift is a virtual reality head-set originally designed for video games. Yes, there have been a lot of attempts at Virtual Reality in the past and no one knows this better than the guy who designed this one, Palmer Luckey. Over a few years he collected about 56 different Virtual Reality Head sets including one that cost $97,000 which he nabbed for $80. He began taking them apart and tinkering with them in his parents garage. Out of that creative process emerged the prototype for what is now known as the Oculus Rift. But just getting the prototype built is one thing but having financial backing to see it built and do it at an affordable cost is very different. That's where Kickstarter.com has helped. Through the use of this "crowd-sourcing" website he raised $2.5 million and gained some momentum in actually bringing the device to the people who could design games for it. He has since recruited a big name in the gaming industry John Carmack among others.  The real reason that I think this could take off though, is not the $16 million that this small start-up has now amassed or the demand for the next cool new gadget. What really intrigues me here is the guy behind product, Palmer Luckey himself. I mean if all I knew was his name, I would guess things will go well for him. But this kid was in community college at 14 and has spent time working fixing and selling cell phones and cleaning boats. He used money he earned to buy his Virtual Reality sets, originally just for his own video gaming pleasure. Upon the realization that there was no better device out there, he took matters into his own hands and been on a mission ever since. According to Wikipedia he was enrolled at the University of Southern California Institute for Creative Technology before transforming into the leader of the group now called Oculus VR. He seems to be passionate about and completely comfortable with hardware engineering and at the same time a non-stop promoter and recruiter. It looks like he has all the elements of a good old fashioned home grown American entrepreneurship, with the right balance of technical thinking and people pleasing.

The real reason that I think this could take off though, is not the $16 million that this small start-up has now amassed or the demand for the next cool new gadget. What really intrigues me here is the guy behind product, Palmer Luckey himself. I mean if all I knew was his name, I would guess things will go well for him. But this kid was in community college at 14 and has spent time working fixing and selling cell phones and cleaning boats. He used money he earned to buy his Virtual Reality sets, originally just for his own video gaming pleasure. Upon the realization that there was no better device out there, he took matters into his own hands and been on a mission ever since. According to Wikipedia he was enrolled at the University of Southern California Institute for Creative Technology before transforming into the leader of the group now called Oculus VR. He seems to be passionate about and completely comfortable with hardware engineering and at the same time a non-stop promoter and recruiter. It looks like he has all the elements of a good old fashioned home grown American entrepreneurship, with the right balance of technical thinking and people pleasing.

The device, if it can deliver for $150, it will do something that the U.S. government has spent millions of dollars trying and failing to develop. It could be used for anything from training to gaming to movies and has the distinct traits of disruptive innovation at work. If nothing else it has been a very inspiring story so far, but barring any unexpected mishaps, I see this going a long way. And I hope it does! This is the type of phenomena drives our economy it creates new industries and probably most importantly sparks your imagination.

Sunday, November 24, 2013

Flower Arrangement in Vase- Still Life

Saturday, October 12, 2013

The Distant View

"Our main business is not to see what lies dimly at a distance but to do what lies clearly at hand." Thomas Carlyle

The distance. Watercolor.

Scott's Flat, Northern CA. I believe.

Scott's Flat, Northern CA. I believe.

Friday, August 23, 2013

The Intelligent Investor

Warren Buffet, largely regarded as the greatest investor of all time, said of Ben Graham "I

attended Colombia University’s business school in 1950-51 not because I cared

about the degree, but because I wanted to study under Ben Graham."

Ben Graham's family immigrated from London in 1894. Graham grew up poor because of the death of his father, and an economic crisis in 1907. He displayed brilliance in academia and was offered a teaching position at Columbia University. He probably would have preferred studying and teaching there but due to the lingering pain of the economic need to support his mother and family, he instead applied his brilliant mind to investing. He was almost wiped out by the crash of 1929 but survived and brought with him the lesson he learned from those experiences. His writing combines a serious sober perspective with mental agility. The work that he did in business has benefited countless investors and added soberness and stability to the financial world ever since

According to Buffet there are three important lessons that were established reading Graham's most popular and fundamental work The Intelligent Investor. Basic number one: Stocks are tiny pieces of businesses. This may seem obvious but people often don't look at the underlying business when they are investing in stocks. They aren't just ticker symbols! They are real live companies that have people have put their blood, sweat and tears into building and maintaining. If they are truly growing, it's because smart, dedicated, hard working people are going in day after day and making things happen. To understand stocks you must understand the people and numbers behind them. There are other ways to invest, you can invest in real estate or land, but when you are buying stocks you are buying businesses. If you wouldn't buy a business maybe you should think twice about buying stocks.

Two: Mr Market. Ben Graham came up with the metaphor Mr. Market. He's this crazy bipolar guy who generally feels optimistic and occasionally gets very depressed. You can't predict what he'll do next and you DO NOT want to get sucked into his mania! What this means is in the stock market it's impossible to predict short term changes because the people buying and selling them are un-predictable. Predictions are difficult and timing things perfectly might as well be impossible. Instead of trying to time your purchases, you should look at the price you are paying. As with anything you buy, look for bargains and keep your own costs down. To determine price Graham suggested looking at Price to Earnings Ratio and Book Value which are still a decent place to start. He said not pay more than 15 Price to Earnings Ratio but look for between 5 and 10, for book value don't pay more than 1.5 times book value but look for less than 1. The companies should also be large, about 1.5 billion and have paid a consistent dividend for 10+ years.

Three:Only purchase if you have a large safety cushion. Graham called this cushion a margin of safety. I think many people (myself previously included) have the false notion that to make more money investing you have to take more risks, which is completely the opposite with value investing. As with many things, to do better at it you have to put more time and effort into it and know your limitations, not take more risk. This cushion also includes reducing your risk in other ways, like not using money you will need any time soon. Graham also recommends holding 10 to 30 companies, essentially not putting all your eggs in one basket. He also recommends having bonds be make up 25-50 percent of your stocks partly for the emotional stability that it will add to your investments.

Warren Buffet, who I'll talk about him more in later posts, has since refined much of Graham's thinking, but I think we still owe a lot to this guy.

http://seekingalpha.com/

http://www.multpl.com/shiller-pe/table

http://www.libertyinvesting.com/blog/

http://www.shillerfeeds.com/

berkshirehathaway.com/letters/letters.html

http://warrenbuffettresource.wordpress.com/

Some other quotes I thought were important from the book:

“One fairly dependable sign of the

approaching end of a bull swing is the fact that new common stocks of small and

nondescript companies are offered at prices somewhat higher than the current

level for many medium sized companies with a long market history.” P. 143

“An enterprising investor is not one who

takes more risks than average or who buys ‘aggressive growth’ stocks; an

enterprising investor is simply one who is willing to put in extra time and

effort in researching their portfolio.” p.159

“Concentrate

on the larger companies that are going through a period of unpopularity…First

they have resources in capital and brain power to carry them through. Second,

the market is likely to respond with reasonable speed to any improvement

shown.” p.163

“The aggressive investor must have a

considerable knowledge of security values, enough to warrant viewing his

security operations as equivalent to a business enterprise. There is no room

for middle ground between passive and aggressive status… The majority of

investors should be defensive.” p. 176

The

longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear

markets are possible. p.190

“The

true investor scarcely ever is forced to sell his shares, and at all other

times he is free to disregard the current price quotation. Thus the investor

who permits himself to be stampeded or unduly worried by unjustified market

declines in his holdings is perversely

transforming his basic advantage into a basic disadvantage. That man would

be better off if his stock had no market quotations at all for he would then be

spared the mental anguish caused him by other

persons mistakes of judgment.” p

203

Price fluctuations have only one signal to

the true investor: they provide him an opportunity to buy wisely when prices

fall sharply and to sell wisely when they advance a great deal. “The

speculator’s primary interest lies in anticipating and profiting from market

fluctuations. The investor’s primary interest lies in acquiring and holding

suitable securities at suitable prices.” p 205

Would you allow a lunatic come by at least

5 times a week to tell you that you should feel exactly the way he feels? Yet

millions of people let Mr. Market tell them how to feel and what to do despite

the fact that from time to time he gets nuttier than a fruitcake. The cheaper

stocks got, the less eager people become to buy them because they are imitating Mr. Market instead of thinking for themselves. By refusing to

let Mr. Market be your master, you transform him into your servant. After all

when he seems to be destroying value, he is creating them elsewhere. p 215

4 “For anyone who

will be investing for years to come, falling stock prices are good news, not

bad since they enable you to buy more for less money. The longer and further stocks fall, and the more steadily you keep

buying as they drop, the more money you will make in the end-if you remain

steadfast until the end. Instead of fearing the bear market you should embrace

it. You should be perfectly comfortable if the market stopped supplying

prices for 10 years. ”

“You will be much more in control, if you realize how much you are not in control.” p 223

"Buying funds based purely on their past performance is one of the stupidest things an investor can do.”

Fund Drawbacks

Conclusions p. 243

1.

The average fund does not pick

stocks well enough to overcome the costs of researching and picking them

2.

The higher a funds expenses,

the lower its returns

3.

The more frequently a fund

trades its stocks, the less it tends to earn

4.

Volatile funds stay volatile

5.

Funds with high past returns

are unlikely to remain winners for long

“Sector funds are the investor’s nemesis.”

The higher the growth rate you project and the longer

the future period over which you project it, the more sensitive your forecast

becomes to the slightest error. P 282

“It is undoubtedly better to concentrate on

one stock that you know is going to prove highly profitable, rather than dilute

your results to a mediocre figure, merely for diversification's sake. But this

is not done because it cannot be done dependably.” P 290

“Corporate

accounting is often tricky; security analysis can be complicated; stock

valuations are really dependable only in exceptional cases.” P 318

“Today’s investor is so concerned with

anticipating the future that he is already paying handsomely for it in advance.

Thus what he has projected with so much study and care may actually happen and

still not bring him any profit. If it should fail to materialize to the degree

expected he may in fact be faced with serious temporary and perhaps even

permanent loss.” P 345

“Surely, then, by the exercise of even a

moderate degree of skill- derived from study, experience and native ability- it

should be possible to obtain substantially better results than the DIJA.” P

376

“It is true that a fairly large segment of the stock market

is often discriminated against or entirely neglected in the standard, than the

intelligent investor may be in a position to profit from the resultant

under-valuations.” P 380

The

vast majority of people who try to pick stocks learn that they are not as good

at it as they thought; the luckiest ones discover this early on, while the less

fortunate take years to learn it.” p 396

“The speculative public is incorrigible. In

financial terms it cannot count beyond 3. It will buy anything, at any

price, if there seems to be some ‘action’ in progress. It will fall for any

company identified with ‘franchising,’ computers, electronics, science,

technology when the particular fashion is raging. Sensible investors are above

such foolishness.” P 437

“Just as the Surgeon General’s warning on

the side of a cigarette pack does not stop everyone from smoking; no regulatory

reform will ever prevent investors from overdosing on their own greed. The

circle can only be broken one investor and one financial advisor at a time.

Mastering Graham’s principles is the best way to start.” P 437

Just as a coin does not become more likely to

turn up heads after landing on tails nine times in a row, so an overvalued

stock (or market) can stay overvalued for a surprisingly long time. p. 466

“It is well established that people often

assign a mental value to stocks based largely on the emotional imagery that

companies evoke. The intelligent

investor always digs deeper.” P 474

“The market scoffs at Graham’s principles in

the short run, but they are always revalidated in the end. If you buy a stock

purely because its price has been going up –instead of asking whether the

underlying company value is increasing-then sooner or later you will be

extremely sorry.” P. 486

"Never dig so deep into the numbers that you

check your common sense at the door..." p.508

"..chief losses to investors come from the purchase

of low-quality securities at times of

favorable business conditions…the

margins of safety is always dependent on the price paid.” P 516

“A sufficiently low price can turn a

security of mediocre quality into a sound investment opportunity.” P 521

Have the courage of your knowledge and experience. If

you have formed a conclusion from the facts and if you know your judgment is

sound, act on it- even though others may hesitate or differ…In the world of

securities, courage becomes the supreme virtue after adequate knowledge and tested judgment are at hand.”

“Limit your ambition to

your capacity and confine you activities within the safe and narrow path of

standard, defensive investment. To achieve satisfactory

investment results is easier than most people realize; to achieve superior

results is harder than it looks.” P 524

“Simply keeping your holdings permanently

diversified, and refusing to fling money at Mr. Market’s latest, craziest

fashions, you can ensure that the consequences of your mistakes will never be

catastrophic.” P 531

“One lucky break,

or one shrewd decision-can count for more than a lifetime of journeyman

efforts. But behind the luck, or the crucial decision, there must usually exist

a background of preparation and disciplined capacity. Interesting possibilities

abound on the financial scene, and the intelligent and enterprising investor

should be able to find both enjoyment and profit in this three ring circus.

Excitement is guaranteed.” P534

“Without a saving faith in the future, no

one would ever invest at all.” P 535

Friday, August 2, 2013

Another guache about for the Neal, ahem I mean the Leading Edge ( http://www.leadingedgemagazine.com/ )this one is for "Of Songs and Solitude." The landscape and foreground is supposed to be the Andes and the background is the lonely solitude of space. This was the first time I had tried painting space and it turned out surprisingly well, I'll probably do something else with stars etc. later on.

Thursday, January 31, 2013

Oil Study of St. Francis by Giovanni Bellini, 1485.

The first time I saw this painting was in an art history class. I was impressed with the golden light that the painting had which reminded of the golden hills of California that I hadn't seen for

awhile. That was where the initial idea came from and it stuck with me for

about a year. Later while I was thinking about something to do a study of, I decided on this picture because it has so many varied subjects, animals, a person, a building and a landscape and its just loaded with color. There's also a feeling of overflowing life, with plants sprouting everywhere and a vibrancy which the monk seems to be feeling, and reflecting. I think of this also as a male counterpart to the statue Ecstasy of St. Theresa by Bernini. For me it conveys a similar thought, although in a different medium.

Subscribe to:

Comments (Atom)